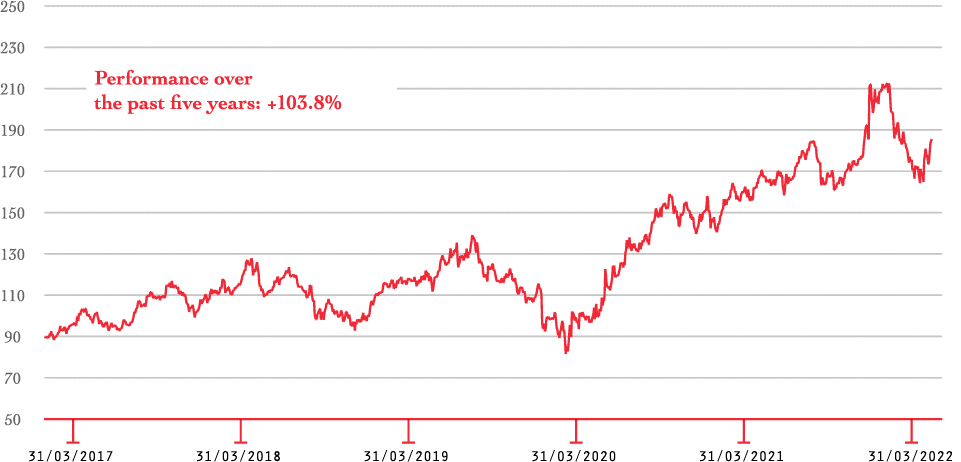

SHARE PERFORMANCE AND DIVIDENDS

THE GROUP’S STRATEGY HAS BOOSTED THE SHARE PRICE OVER THE PAST FIVE YEARS

Rémy Cointreau shares have risen by 103.8% over the past five years, reflected in an increase of nearly €5 billion in its market capitalisation.

This value creation confirms the relevance of the strategy put in place by the Executive Committee and implemented by the Group’s employees.

This graph represents the share performance and dividends.

31/03/2017: approximately 95

31/03/2018: approximately 113

31/03/2019: approximately 116

31/03/2020: approximately 90

31/03/2021: approximately 161

31/03/2022: approximately 188

Performance over the past five years: +103.8%

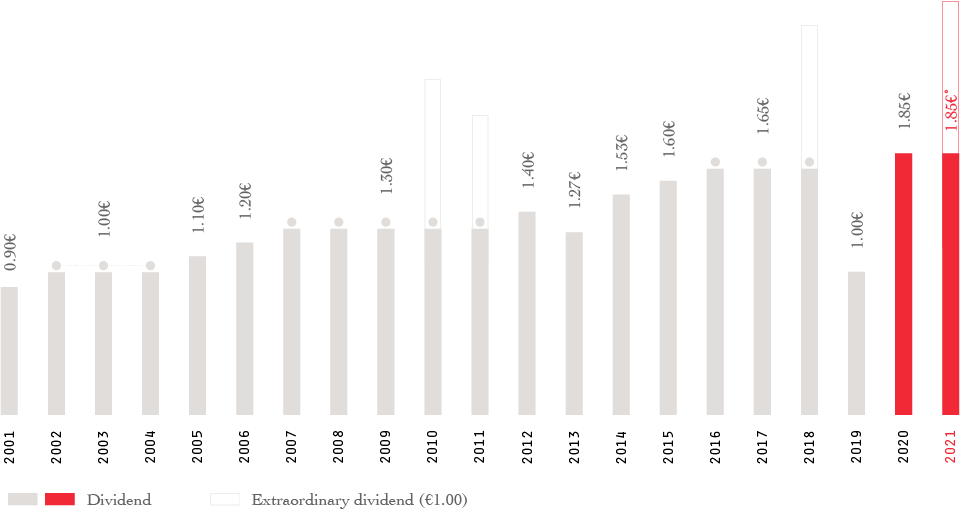

REGULAR DIVIDEND POLICY

Over the past 20 years, the Group has paid an annual dividend which has increased in stages. In addition, it paid an extraordinary dividend of €1.0 per share in respect of 2010/2011, 2011/2012, 2018/2019 and 2021/2022*.

This graph shows the regular dividend policy of the group.

Dividend

2001: €0.90

2003: €1.00

2005: €1.10

2006: €1.20

2009: €1.30

2012: €1.40

2013: €1.27

2014: €1.53

2015: €1.60

2017: €1.65

2019: €1.00

2020: €1.85

2021: €1.85 (Extraordinary dividend (€1.00))

* Dividend proposed to the Shareholders' Meeting of 21 July 2022.