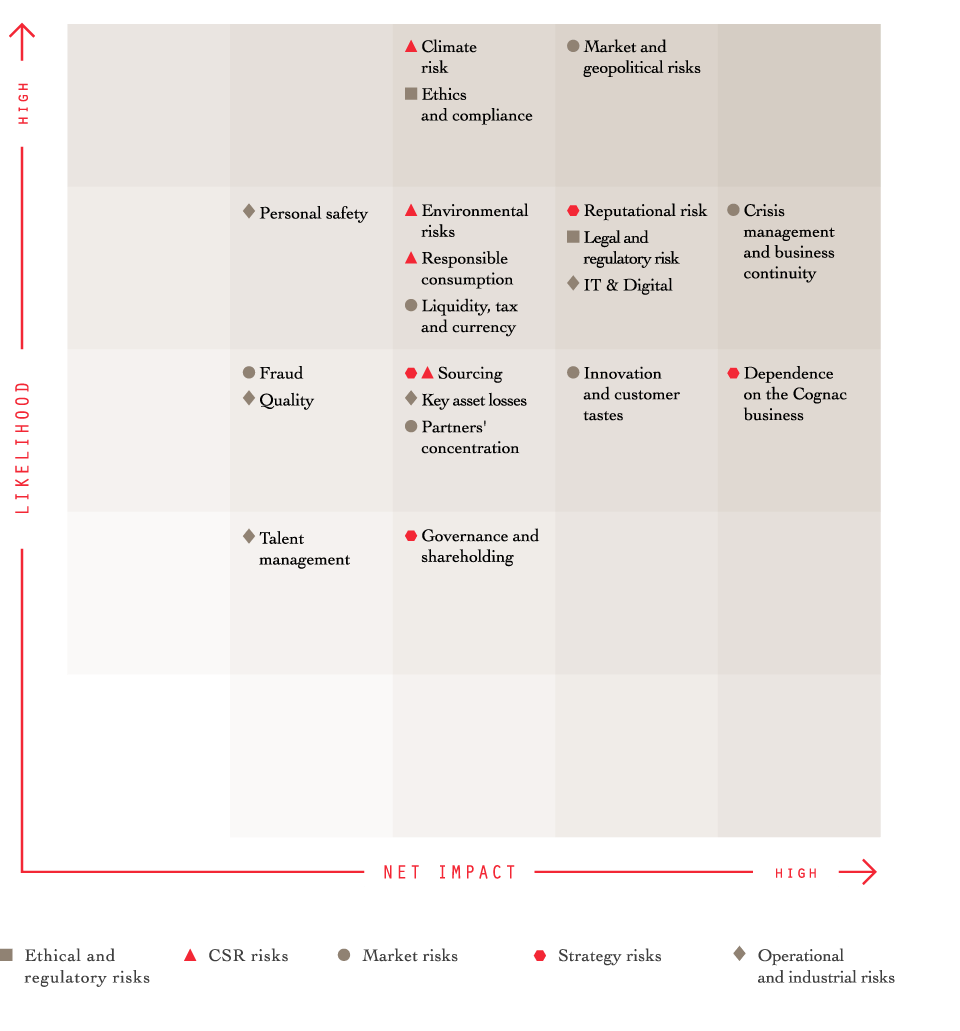

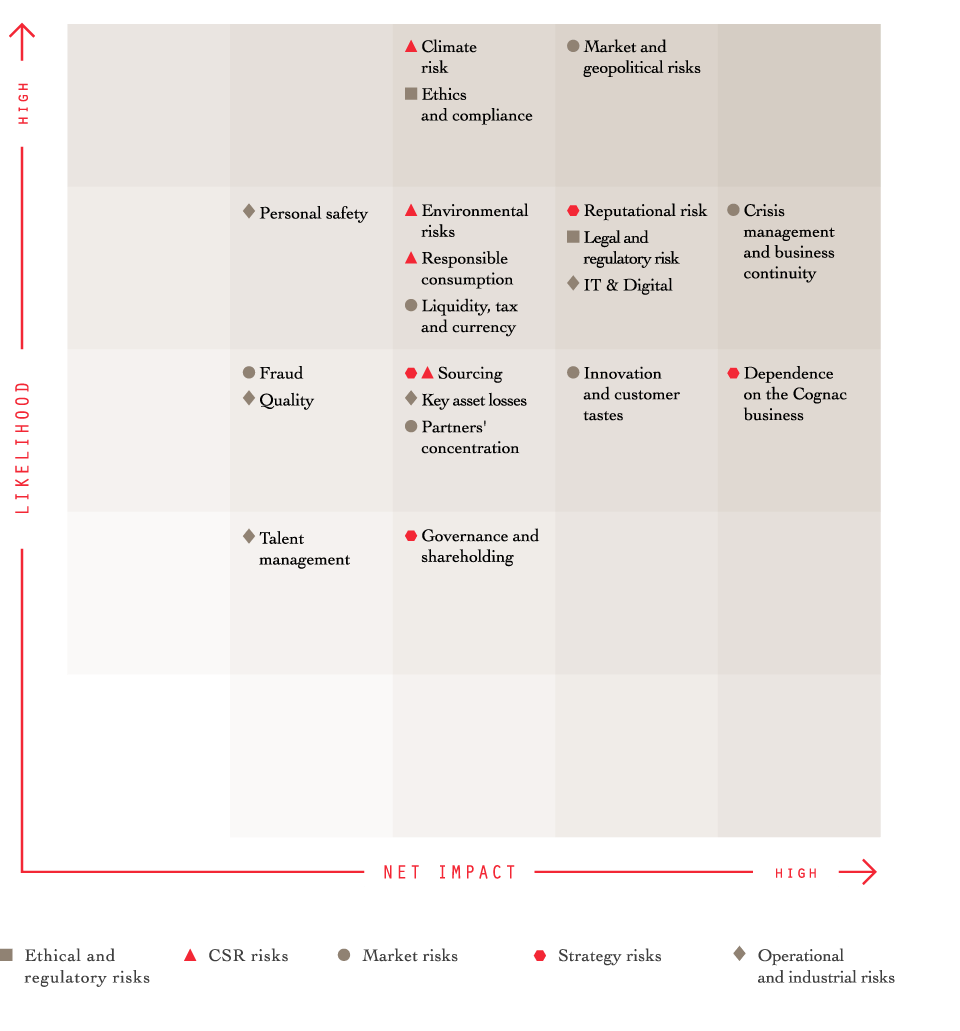

This diagram illustrates the main strategic and financial risks of the Remy Cointreau

Group.

Ethical and regulatory risks

Legal and regulatory risks

Net impact: high

Likelihood: high

Ethics and compliance

Net impact: high

Likelihood: high

CSR risks

Sourcing

Net impact: medium

Likelihood: medium

Responsible consumption

Net impact: medium

Likelihood: high

Environmental risks

Net impact: medium

Likelihood: high

Climate risk

Net impact: medium

Likelihood: high

Market risks

Fraud

Net impact: medium

Likelihood: medium

Partners’ concentration

Net impact: medium

Likelihood: medium

Innovation and customer tastes

Net impact: medium

Likelihood of occurrence: high

Liquidity, tax and currency

Net impact: medium

Likelihood of occurrence: high

Crisis management and business continuity

Net impact: high

Likelihood: high

Market and geopolitical risks

Net impact: high

Likelihood: high

Strategy risks

Sourcing

Net impact: medium

Likelihood: medium

Governance and shareholding

Net impact: medium

Likelihood: medium

Dependence on the Cognac business

Net impact: high

Likelihood: medium

Reputational risk

Net impact: medium

Likelihood: high

Operational and industrial risks

Talent management

Net impact: medium

Likelihood: medium

Quality

Net impact: medium

Likelihood: medium

Key asset losses

Net impact: medium

Likelihood: medium

IT and digital

Net impact: high

Likelihood: high

Personal safety

Net impact: high

Likelihood: high